Philanthropist Robert F. Smith Launches HBCU Tour Help Students

Acclaimed writer and Broadway playwright Lorraine Hansberry once posed the prolific question: what does it mean, “to be young, gifted, and Black?” Nearly 60 years later, the sobering reality that persists for many Black American students seeking a college education in navigating the challenges of being young, educated, Black and broke.

Overburdened with crushing, disproportionate levels of student debt, they are playing catch-up from the first day they step foot onto a college campus. As a result, they start their careers strapped with significantly more educational debt than most white college graduates. More than 70 percent of Black students go into debt to pay for higher education, compared to 56 percent of white students, according to the American Association of University Women. The Association’s recent report also found that Black women carry about 20 percent more student debt than their white counterparts, owing an estimated $41,466 in undergraduate loans in comparison to the $33,851 that white women owe.

The Brookings Institute finds that the Black-white disparity in student loan debt more than triples after graduation, with Black college graduates owing $7,400 more on average than their white peers ($23,400 versus $16,000). And that regardless of the incomes they make after graduation, Black households carry more student debt, affecting their creditworthiness and ability to save money or buy homes. The debt difference tends to worsen over time, in part because of the longstanding racial wealth gap, which is only beginning to gain interest on the heels of America’s racial reckoning reignited in 2020.

Billionaire philanthropist Robert F. Smith is all too familiar with the ongoing student debt crisis and he’s doing his part to try and help. Smith drew headlines in 2019 when he pledged a $34 million gift to Atlanta’s historically Black Morehouse College, paying off student balances for 400 graduates. In the spirit of that life-changing support, this Fall he has launched the Student Freedom Initiative tour on the campuses of an initial cohort of nine Historically Black Colleges and Universities (HBCUs). It provides science, technology, engineering, and mathematics (STEM) majors at Minority Serving Institutions (MSIs), starting with HBCUs, opportunities to receive educational grants of up to $20,000 per academic year, filling the gap after financial aid awards.

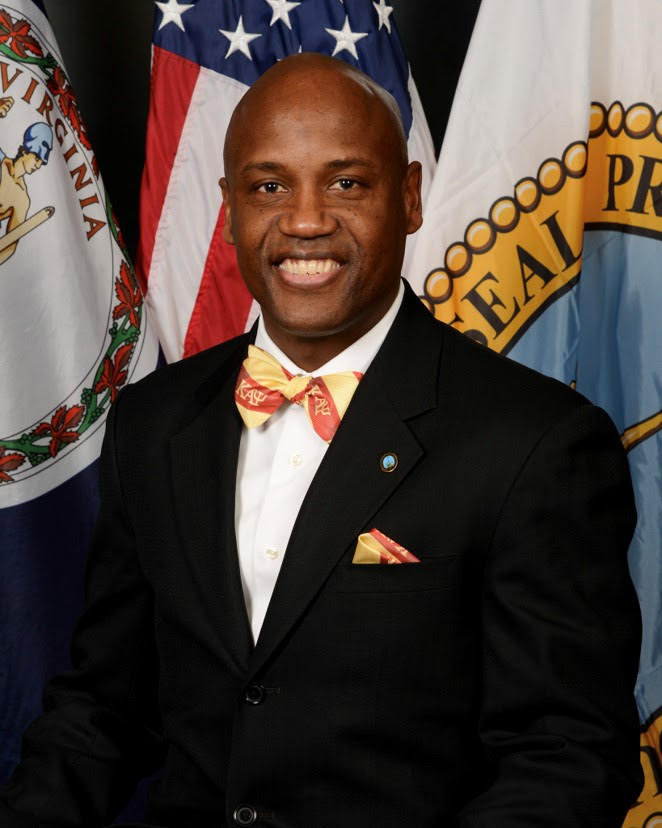

The overarching goal is to provide students with alternative funding sources, in lieu of pursuing traditional student loans or their parents having to take out Parent PLUS loans, which are unsubsidized federal loans with higher interest rates and fees. “This is to help significantly reduce their financial indebtedness, which we believe is largely driven by long-standing economic disparities that persist in American society,” says the Student Freedom Initiative’s Executive Director Mark Brown. “We provide them with opportunities to receive income-contingent funding in lieu of traditional college loans that have long wreaked havoc on their financial futures. These income-contingent agreements, which we refer to as Student Freedom Agreements, are based on a ‘pay it forward’ concept; meaning they pay it back only when they’re working and their payments are based solely on their income.”

Smith, who serves as chairman of the 501(c)(3) organization, says the objective is to provide HBCU students with long-term financial freedom. “Through the Student Freedom Initiative we hope to give Black students access to the education they need to move forward in this digital economy without the burden of student loan debt stopping them from realizing their fullest potential,” says Smith, who also helms the private equity firm Vista Equity Partners. “While our community continues to face inequities. that too often bar young students of color from accessing quality higher education, the Student Freedom Initiative aims to empower our students with the tools they need to control their financial futures.”

The students also have the opportunity to receive micro-grant funding for emergency situations that arise, along with career development opportunities established through partnerships with Fortune 100 companies. “Eligible students may receive at least two paid internships during their college careers, what we like to call ‘immersive work experiences,’” notes Brown, a Tuskegee University alum. “We are taking a holistic approach in our drive to empower and prepare the next generation of students. We’re betting on them, that given the right investment they will go out and do well!”

Additionally, with the help of tech partners Cisco and AVC Technologies, the Student Freedom Initiative is also funding campus visits throughout the 2021-22 academic year to Claflin University, Clark Atlanta University, Florida A&M University, Hampton University, Morehouse College, Prairie View A&M University, Tougaloo College, Tuskegee University and Xavier University of Louisiana, providing free technology infrastructure upgrades.

The Student Freedom Initiative’s partners work directly with the HBCUs to identify gaps and upgrade existing campus cybersecurity infrastructure, in an effort to help them reach compliance with a federal mandate from the U.S. Department of Education (ED) Federal Student Aid (FSA) Office. To date, more than 22 HBCUs have signed agreements to receive the upgrades funded by $250 million in generous pledges: including a $150 million contribution from Cisco, along with first-round grants from the Walmart Foundation as part of The Walmart.org Center for Racial Equity and additional support from the United Negro College Fund.

To learn more, visit StudentFreedomInitiative.org. Brown is available to share his insights on the student debt crisis disproportionately affecting students of color, along with details of the Student Freedom Initiative Tour and Campus Cybersecurity effort.

(Editor’s Note: This story first appears in Black News)