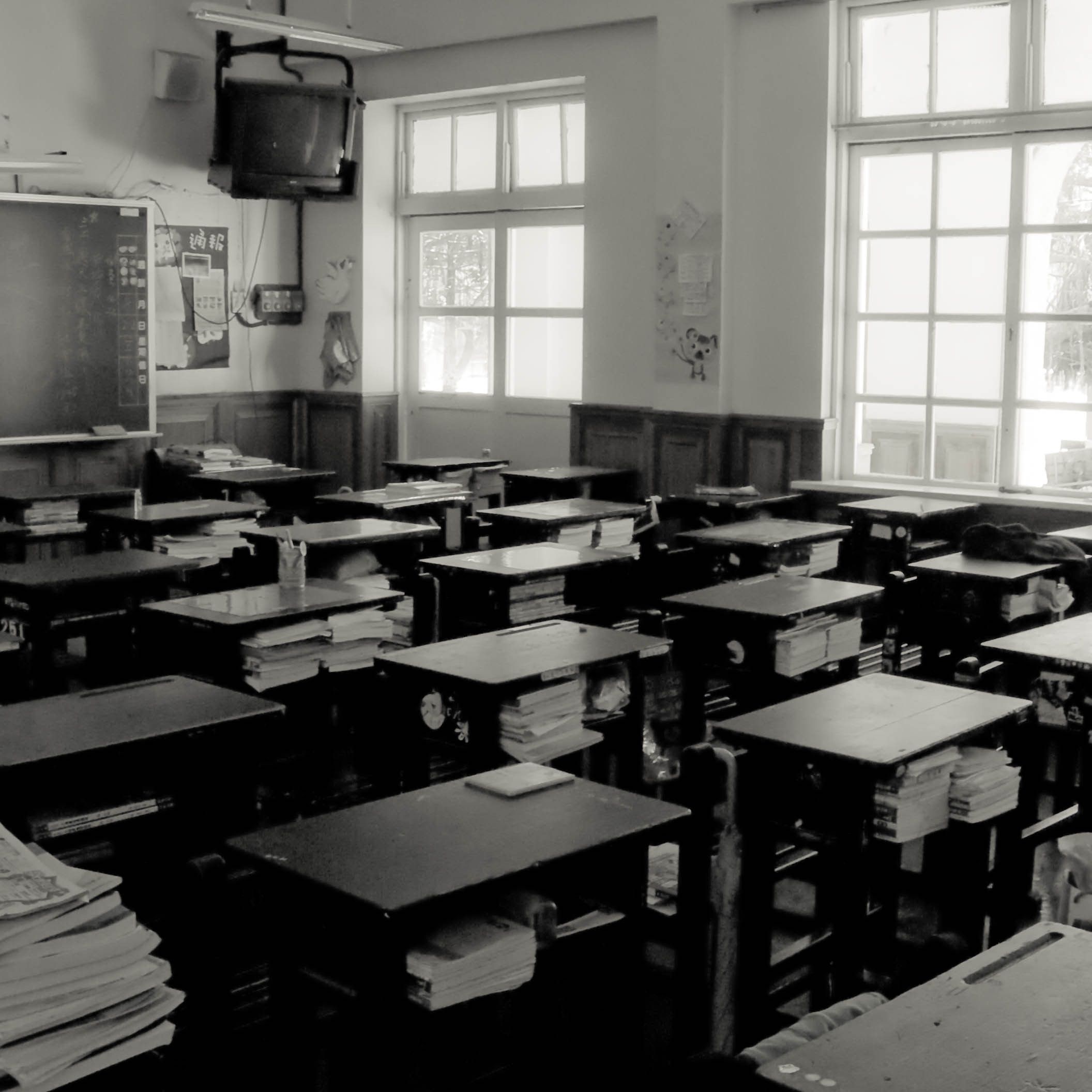

Financial literacy classes in public schools are at last a reality

Schools are created to be institutions of learning the basics that one needs to succeed in the business world: Math, English and so on. However, there has always been one topic that was rarely, if ever, taught in a manner that truly benefitted both the student and parent: financial literacy. Students would graduate with a high school diploma or GED with a set of skills, but not in the arena of proper stewardship over their money. Today, among several other laws that were signed as a result of them being passed during the Virginia General Assembly, was House Bill 1905, which mandates for financial literacy courses in middle and high schools.

Led by patrons such as Delegate Joshua Cole (D-28th) and a host of other Democrats, the bill states as follows: “The Board of Education shall develop and approve objectives for economics education and financial literacy at the middle and high school levels, that shall be required of all students, and shall provide for the systematic infusion of economic principles in the relevant Standards of Learning, and in career and technical education programs. The objectives shall include personal living and finances; personal and business money management skills; opening an account in a financial institution and judging the quality of a financial institution’s services; balancing a checkbook; completing a loan application; the implications of and differences between various employment arrangements with regard to benefits, protections, and long-term financial sustainability; the implications of an inheritance; the basics of personal insurance policies; consumer rights and responsibilities; dealing with salesmen and merchants; debt management; managing retail and credit card debt; evaluating the economic value of postsecondary studies, including the net cost of attendance, potential student loan debt, and potential earnings; state and federal tax computation; local tax assessments; computation of interest rates by various mechanisms; understanding simple contracts; and learning how to contest an incorrect bill.”

The Virginia Board of Education will establish curriculum objectives along with banking-at-school programs. While it is not required at all public schools, the VDOE will provide guidance for school divisions that implement these courses.