Board of County Supervisors vote to impose annual license tax penalty

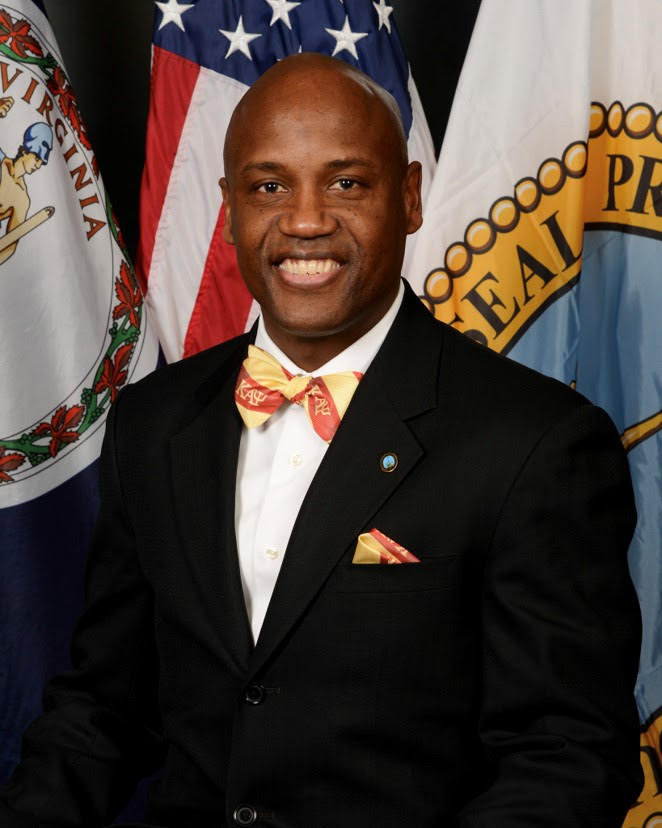

Woodbridge Supervisor Franklin only one to vote in opposition

Yesterday, during the bi-weekly Board of County Supervisors meeting, one of the agenda items was ordinance No. 21, which was the imposition of an annual license tax penalty for owners of motor vehicles that do not display current Virginia license plates and an additional penalty for owners who fail to timely register their motor vehicles.

The ordinance states as follows: “authorizes localities to impose, by ordinance, a license tax in an amount not to exceed $100 annually upon owners of motor vehicles that do not display current license plates and are not exempt under the requirements of displaying

such license plates under applicable Virginia law; and a penalty of up to $250 upon the resident owner of any motor vehicle that is required

to be registered in Virginia but has not been registered.” In addition, according to the ordinance, the license tax may be billed and collected as personal property taxes are billed and collected or may be billed and collected separately.

Prince William County, by adopting this measure, follows in the footsteps of Fairfax, Loudoun and Arlington counties as well as the City of Alexandria, who adopted such an ordinance which gives them authority to assess a License Plate Tax and Penalty on their bills, in addition to

their locally codified personal property tax.

This continues a pattern in which marginalized communities, specifically of color, are being punished and charged with heavy fines in a time where families are struggling to make ends meet post-pandemic, and poverty once again is being criminalized.